Gold fell from a fresh seven-year high on Monday as early results from a coronavirus vaccine trial showed promising results, offering a glimpse of hope that a path to economic recovery could be paved.

Though still at an early stage and based on small sample size, Moderna, the US biotech company behind the vaccine development, said its tests showed signs that the vaccine can create an immune-system response in the body that could help fend off the virus.

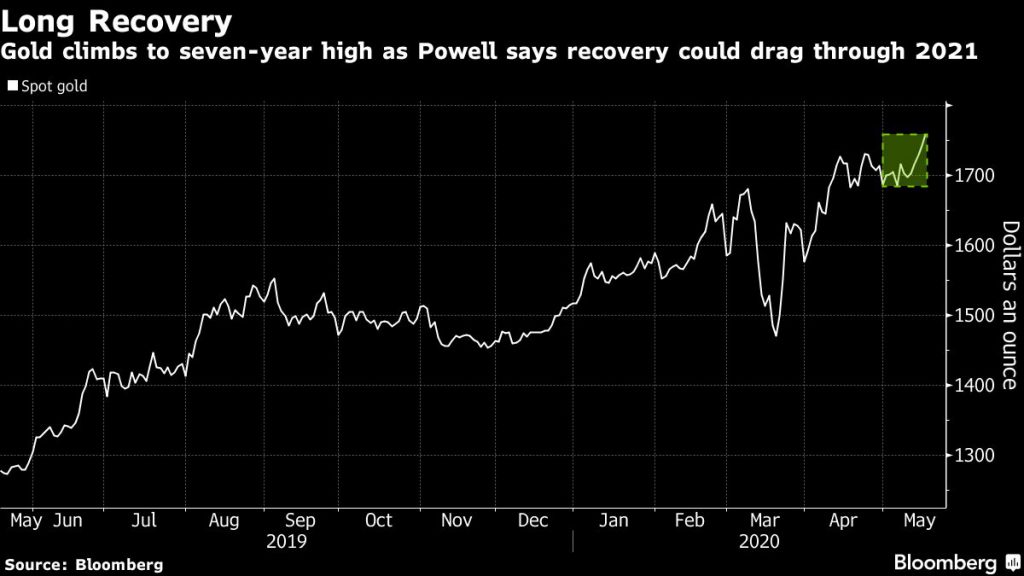

Spot gold jumped as much as 1.2% to $1,764.73 an ounce during the early hours — the highest since October 2012 — but has since cooled off, trading at $1,730.52 an ounce as of 2 p.m. EST.

Gold futures for June delivery also rose 1.0% earlier to $1,775.8 an ounce before falling down to $1,734.50 on the Comex in New York.

Gold has been gaining momentum recently over concerns over a second wave of covid-19 outbreak as economies attempt to reopen.

US Federal Reserve said in a report last Friday that stocks and asset prices could “suffer a significant hit,” should the covid-19 pandemic deepen, bolstering the appeal of gold as a safe haven for investors.

In an interview, Chairman Jerome Powell warned that a full economic recovery could drag through until the end of 2021, depending on the delivery of a vaccine.

“Asset prices remain vulnerable to significant price declines should the pandemic take an unexpected course, the economic fallout prove more adverse, or financial system strains reemerge,” the Fed said in the report.

Data also showed that US retail sales and industrial production both plunged last month, with the coronavirus crisis continuing to pummel the US labour market. The report cited commercial real estate as being particularly susceptible to falling valuations because “prices were high relative to fundamentals before the pandemic.”

Bullion has surged 16% this year as investors turned to gold for protection in the wake of the economic turmoil created by the coronavirus outbreak and the unprecedented scale of government response to assuage the decline.

The possibility of further interest rate cuts and the ensuing threat of inflation have also made a case for holding the metal, evident in the record holdings in gold-backed exchange-traded funds.

“The market continues to speculate about negative interest rates in the US and extremely low interest rates and cheap money all over the world,” Commerzbank analyst Eugen Weinberg told CNBC. “Also, fears of economic crisis are unfolding given the very weak data in the United States and elsewhere.”

“Financial markets can best be described as factoring in the best-case scenario, with economic stimulus leading to a rapid recovery,” Gavin Wendt, senior resource analyst at MineLife Pty, said in a Bloomberg interview.

“The reality is likely to be quite different and there is the prospect that no vaccine will be developed. The recovery is probably set to be more problematic than the optimists think, with gold set to benefit from the enormous boost to money supply that is going to ensue,” Wendt told Bloomberg.

Palladium rally

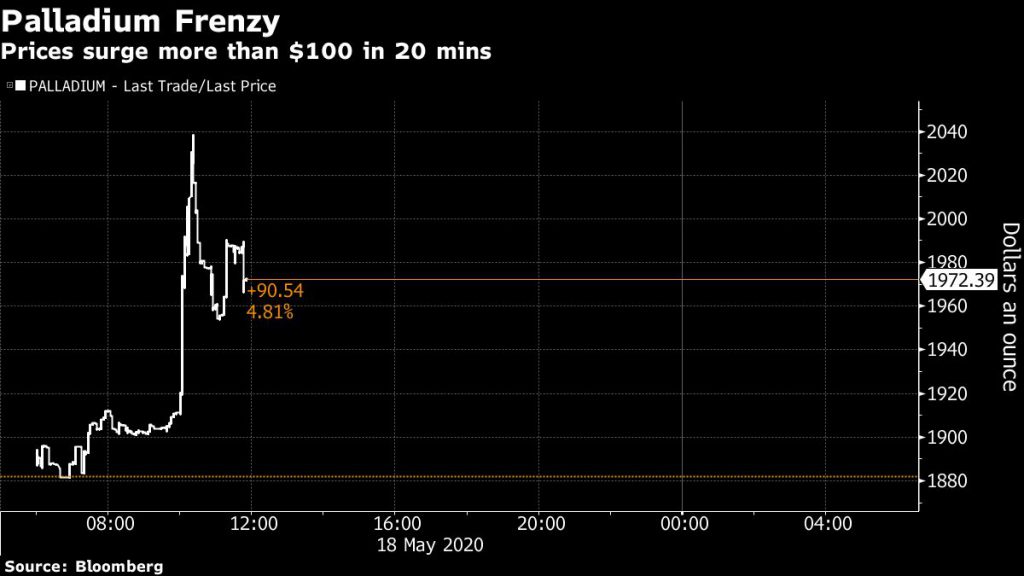

Gold is not the only precious metal in the spotlight on Monday. Palladium topped $2,000 an ounce once again and jumped as much as 8.3%, the most since March 25, amid renewed optimism about China’s economy reopening and planned stimulus for automakers.

Last week, the world’s largest palladium producer, Norilsk Nickel PJSC said demand for the battery metal may drop 16% this year, the most in almost two decades.

“Palladium is seeing strength on supply concerns due to the virus-related reduction in mining activities,” Gnanasekar Thiagarajan, director at Commtrendz Risk Management Services Pvt, told Bloomberg. “During May-June output is expected to be lower.”

In other precious metals, silver climbed as much as 4% and platinum advanced 3.5%. Both metals are facing supply concerns as Mexico, the world’s biggest silver producer, has yet to resume mining activities, while South Africa is having its own issues in steering platinum production back on track.

Fonte: Mining.com