Solaris Resources (TSX:SLS) (NYSEAmerican:SLSR) has announced the execution of US$200 million in financing agreements with RGLD Gold AG (“Royal Gold”), a subsidiary of Royal Gold, Inc. The funding package comprises a gold stream and a net smelter return royalty. US$100 million is immediately available to Solaris. The company states that the financing will be used to repay its senior secured debt facility with Orion Mine Finance Management LP and is anticipated to provide the necessary funds for value-accretive derisking activities through to a final investment decision for the Warintza project.

According to Solaris, the gold stream is expected to represent a small percentage of the gold produced over the mine’s life. The company also noted that a stream termination provision exists without penalties in the event of a change-of-control scenario. Solaris emphasized that it has maintained strategic optionality regarding future project financing and that the funding package is restricted to the Warintza cluster, preserving exposure to exploration upside within the Warintza district.

The total US$200 million consideration from Royal Gold will be paid in three tranches:

- US$100 million upon the closing of the transaction, which was concurrent with signing.

- US$50 million following the publication of the Pre-Feasibility Study and receipt of the Environmental Impact Assessment technical approval.

- US$50 million on the first anniversary of the closing date and completion of necessary security filings.

The closing of the second and third tranches is subject to customary conditions. Solaris intends to use the proceeds for technical studies, permitting activities, early infrastructure development, repayment of the Senior Debt facility, some district exploration, general working capital, and to fully fund the company through to a final investment decision.

Under the terms of the stream agreement, Royal Gold will receive gold deliveries equivalent to 20 ounces per 1 million pounds of copper produced from the designated Stream Area of Interest. For each ounce of gold delivered, Royal Gold will pay Solaris 20% of the spot price until 90,000 ounces have been delivered, and 60% of the spot price thereafter.

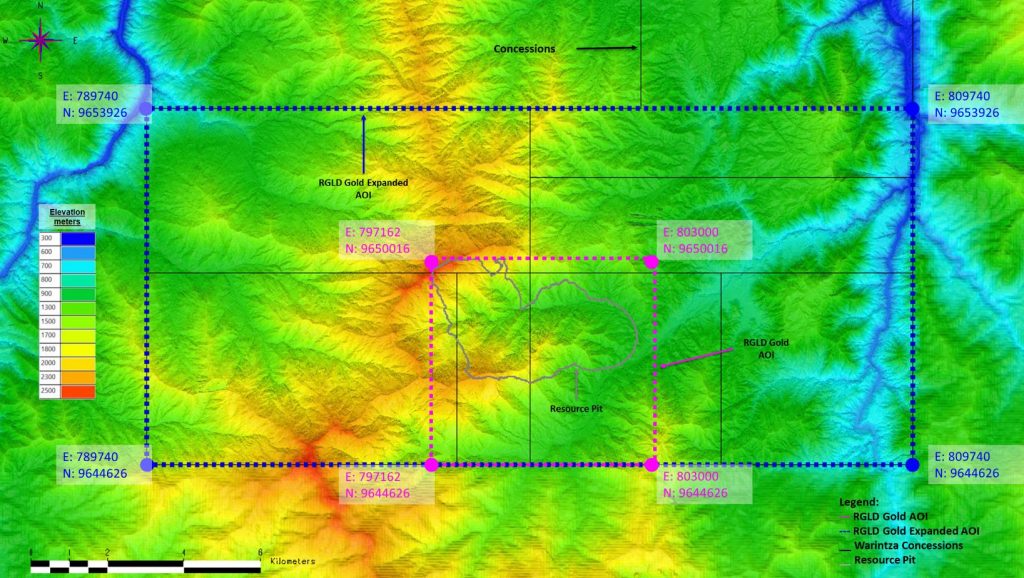

The royalty agreement grants Royal Gold a 0.3% net smelter return royalty on all metal production from the Expanded Area of Interest. This royalty will increase annually by 0.0375%, up to a maximum of 0.6%, until the earlier of the first gold delivery under the stream or eight years following the closing date.

The Stream Area of Interest is limited to a defined area around the mineral resource. If commercial production does not commence within eight years and the first stream delivery has not occurred, the stream area will expand to the Expanded Area of Interest. The royalty applies to the entire Expanded Area of Interest. In the event of a change of control where Royal Gold terminates the stream, the royalty area would revert to the Stream Area of Interest. Solaris retains the option to spin out non-core properties within the Expanded Area of Interest (excluding the Stream Area of Interest), in which case a 1.2% royalty would immediately apply to those properties.

In the event of a change-of-control transaction within five years of closing or before the first stream delivery, either party may choose to terminate the stream and return all advance payments without penalty. The royalty would remain in place and could automatically increase to 0.6% under certain change-of-control circumstances. Royal Gold has also committed to financially supporting Solaris’s environmental and social programs. The financing structure is designed to subordinate the stream and royalty to any future project financing.

Matthew Rowlinson, President and CEO of Solaris, stated: “This transaction is a clear endorsement of the potential scale, geological qualities and its near surface nature, economics and stage of development of Warintza, one of the few remaining near-term, globally significant copper development opportunities not controlled by a major. Further, it’s a reflection of the strong investor confidence in Ecuador as a mining jurisdiction, supported by the government’s commitment to the sector as a pillar of long-term economic development. The Stream is expected to represent a small percentage of the gold over the life of mine and together with the Royalty, enables the Company to maintain the project’s strategic flexibility. Through partnering with Royal Gold, a leader in the precious metals streaming and royalty space, this has not only brought very competitive cost of capital to the table, but a valued strategic relationship. We are proud of our team for executing a process that brought in a high-quality partner on accretive terms and we look forward to a long and successful partnership with Royal Gold, continuing to deliver on our commitment to unlocking value for all stakeholders.”

Richard Warke, Non-Executive Chairman of Solaris, also commented in a press release: “Congratulations to the management team for successfully securing a funding package that marks a major milestone in Warintza’s development. This financing structure provides Solaris with long-term liquidity while maintaining corporate flexibility going forward, allowing the Company to fully enhance shareholder value. Their swift efforts have positioned us for growth without foreseeable share dilution — a key win for our shareholders. This progress builds on the historic work performed that laid the foundation for Warintza’s transformation into a world-class, global scale multi-generational copper asset.”

Solaris anticipates publishing its Pre-Feasibility Study in Q3 2025 and will then proceed with the Bankable Feasibility Study. The technical review of the Environmental Impact Assessment is underway, with approval targeted for mid-2025. All project exploitation permits are expected by mid-year 2026. The company also expects to publish an updated Mineral Resource Estimate in Q3 2025 following the completion of over 82,000 meters of infill drilling. Solaris is also pursuing exploration activities across its broader land package.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

The post Solaris Resources (TSX:SLS) Secures US$200 Million Financing Agreements with Royal Gold for Warintza Project appeared first on MiningFeeds.