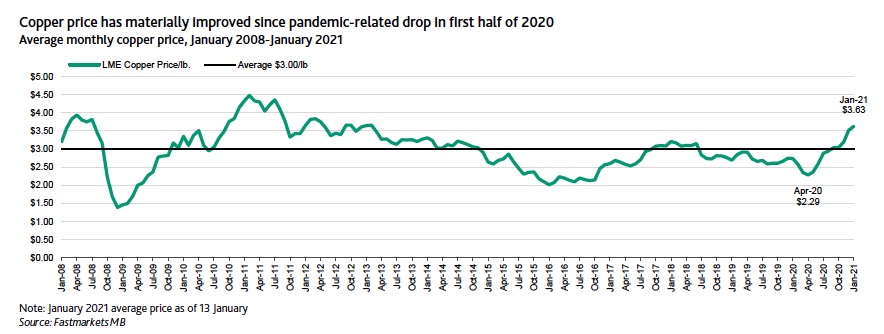

Copper prices turned higher again on Wednesday on hopes stimulus in the US will further boost demand for the bellwether metal, already in short supply amid an Asian factory and construction boom and disruptions in top producing countries.![]()

On the Comex market, copper for delivery in March advanced 0.8% to $3.6640 a pound ($8,078 a tonne) in New York, not far off near-eight year highs hit in the first week of the new year.

The debt ratings agency pegged its price range at between $2.25 to $3.00 a pound from a high point of $2.75 previously adding that it anticipates prices will remain above this range in the near term, and will favor the upper portion of the range in 2021.

Moody’s believes prices will ease from the January highs levels during 2021-22 as supply normalizes through 2021, in particular in large producing countries such as Chile and Peru, which together account for about 40% of world copper production.

The market will remain tight over the next six to 12 months, with new supply delayed because lockdowns and mobility restrictions last year led copper producers to suspend projects in progress.

Industrial activity and infrastructure investment, as well as economic recovery in developed countries that are large users of copper, such as Japan, the US, and the EU and the UK will also buoy prices:

We see long-term demand fundamentals as positive, based on infrastructure investments and an ongoing gradual shift toward electric vehicles.

Incremental supply coming from greenfield projects remains limited, while some brownfield expansions will only replace depleting reserves, rather than adding to overall capacity, which supports long-term copper prices.

Fonte: Mining.com