China aims for ‘Olympic Blue’ with plans to extend steel curbs (Image: International Olympic Committee)

The Iron ore price fell for a fifth straight session on Tuesday and hit a more than four-month low, as concerns about weakening Chinese demand kept the metal under pressure.

The most-traded iron ore contract for January 2022 delivery on China’s Dalian Commodity Exchange ended daytime trading 1.3% lower at 853 yuan ($131.64) a tonne, after earlier touching 823 yuan, its lowest since March 26.

According to Fastmarkets MB, benchmark 62% Fe fines imported into Northern China were changing hands for $162.44 a tonne, down 5.8% from Monday’s closing, pressured by China’s move to reduce steel output in line with its de-carbonization drive.

“The world’s steel sector will need to prioritise de-carbonisation to meet a challenging target of cutting carbon emissions by 75% to keep global warming to within 2 degrees Celsius,” Wood Mackenzie said in a note.

“Advanced economies will need to do more to curb emissions via innovative new steelmaking pathways such as hydrogen use.”

Olympic blue

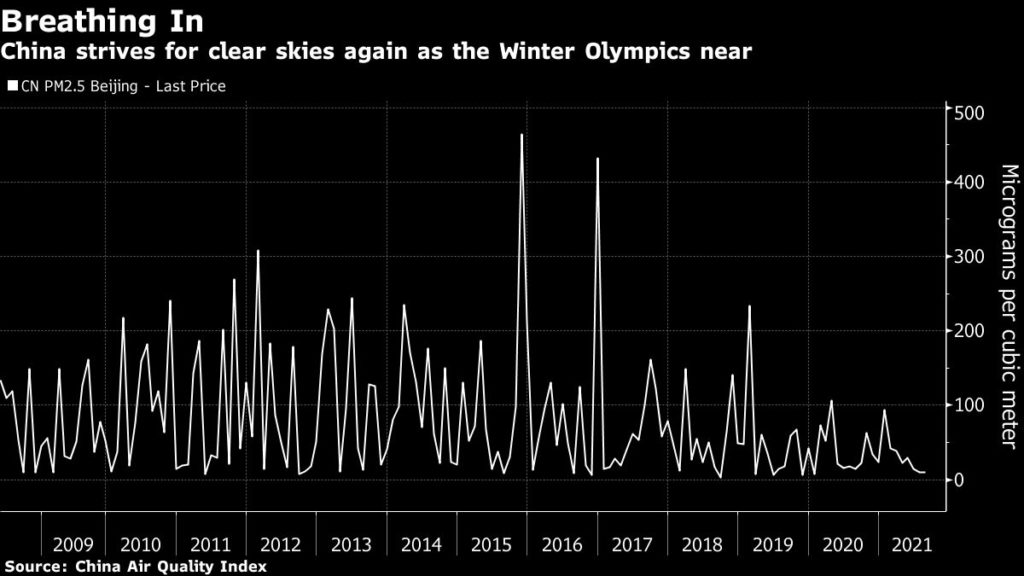

China’s iron ore appetite may remain weak beyond 2021, as further steel output controls loom ahead of the Beijing Winter Olympic Games in February.

Steel hub Tangshan will extend existing curbs to March 13 next year to ensure good air quality for the games, researcher Mysteel reported, citing a draft document issued by the city’s environmental office.

Air pollution in Tangshan should fall by at least 40% year-on-year in the days leading up to and during the Games, which start on Feb. 4.

The city’s steelmakers account for 8% of global output.

When Beijing hosted the Summer Olympics in 2008, authorities shut a swathe of factories in the industrial regions near the capital. The operation, dubbed “Olympic Blue”, was a success: Beijingers enjoyed blue skies for an entire month.

The Olympics curbs come amid a gathering nationwide push to reduce steel output after production smashed records in the first half of the year. Mills in Tangshan — which churned out 144 million tonnes in 2020 — will have to reduce production by 12.4 million tonnes this year, while the broader Hebei province is aiming for a 21.7 million-tonne reduction.