The iron ore market is focused mainly on developments in China, which isn’t surprising given the world’s biggest buyer of commodities takes about 70% of global seaborne cargoes.

But that other 30% does matter – and there are signs of a recovery in demand in the wake of the coronavirus pandemic.

The total global volume of seaborne iron ore discharged at ports in January was 134 million tonnes, according to vessel-tracking and port data compiled by Refinitiv.

This was up from 122.82 million tonnes in December and 125.18 million in November, and also some 6.5% higher than the volume for January 2020.

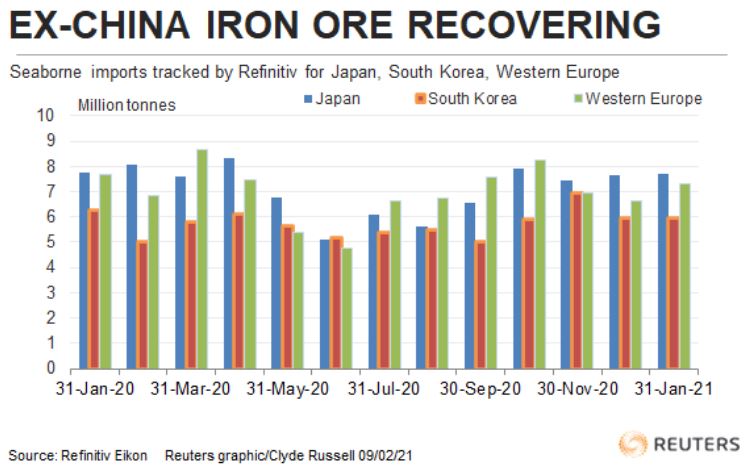

These figures do point to a recovery in the world seaborne market. And the breakdown does lend support to the view that the major buyers other than China – namely Japan, South Korea and Western Europe – are starting to pull their weight.

China’s seaborne imports of the steel-making ingredient in January were 98.79 million tonnes, meaning the rest of the world was at 35.21 million.

For the same month in 2020, imports by the world ex-China were 34.07 million tonnes, a rise of 3.3% year-on-year.

That may not seem like a massive increase, but in terms of the damage done to the global economy during the lockdowns to combat the spread of the coronavirus during much of 2020, it’s actually a solid rebound.

Japan’s iron ore imports were 7.68 million tonnes in January, up marginally from 7.64 million in December and 7.42 million in November, but down a touch from the 7.78 million in January 2020.

South Korea imported 5.98 million tonnes in January, up a smidgeon from 5.97 million in December, but down from 6.94 million in November, and also below the 6.27 million from January 2020.

Imports by Western European countries stood at 7.29 million tonnes in January. That was up from 6.64 million in December and 6.94 million in November, and only slightly below the 7.78 million from January 2020.

It’s of note that Western Europe’s imports have rebounded 53.2% from the 2020 low of 4.76 million tonnes in June.

Similarly, Japan’s January imports were 51.2% above the lowest month last year, the 5.08 million tonnes from June, and South Korea’s were 19.6% stronger than the worst month in 2020, the 5 million tonnes from February.

PRICE SUPPORT?

Overall, what the data show is that while China is still the dominant importer of iron ore, and swings in Chinese demand have an outsized impact on volumes, the role of the smaller importers is likely being underestimated.

This is especially the case if the growth in Chinese demand, seen in the second half of 2020 as Beijing ramped up stimulus spending, starts to fade as the monetary taps are tightened somewhat in 2021.

A recovery in Japan, South Korea and other smaller Asian importers would work to offset any moderation in Chinese demand.

Western Europe is somewhat separate to Asia as an iron ore market. But one of its top suppliers is Brazil, and rising demand will have the effect of lowering the amount of iron ore the South American country can ship to China.

Also, if Western Europe’s demand was weak, it would have meant that some its suppliers, such as Canada, would have been encouraged to ship to Asia, thus boosting competition with the iron ore heavyweights – Australia, Brazil and South Africa, the world’s top three shippers.

Iron ore prices are still largely driven by China market dynamics, and the spot price for benchmark 62% ore, as assessed by commodity price reporting agency Argus, has remained at historically high levels as China’s demand has been resilient.

The spot price ended at $159.60 a tonne on Monday, up from the low so far this year of $149.85 on Feb. 2, but down from the $175.40 on Dec. 21 – the highest price in nearly 10 years.

Iron ore prices have come under pressure in recent weeks on the back of signs that Beijing may taper its stimulus spending this year, and official comments that steel output should be lower to reduce pollution and energy consumption.

It may be the case that stronger demand in the rest of Asia is lending some support to prices.

Fonte: Hellenic Shipping News