Iron ore prices are consolidating in the international market amidst an ambiguity over the demand and supply dynamics; however, the prices of the commodity are still trading around the multi-year high levels amid supply shortage.

The prices of most actively trading iron ore futures (September series) on the Dalian Commodity Exchange (or DCE) are noted to be in the range of RMB 865.00 to RMB 924.50; while the prices of the July series iron ore futures on the Chicago Mercantile Exchange (or CME) are observed in the range of US$120.25 to US$121.19.

China Iron and Steel Association (or CISA) adopted a measure to curb the spiking iron ore prices previously, and the prices are currently trading lower in China as compared to the recent top-level of RMB 924.50.

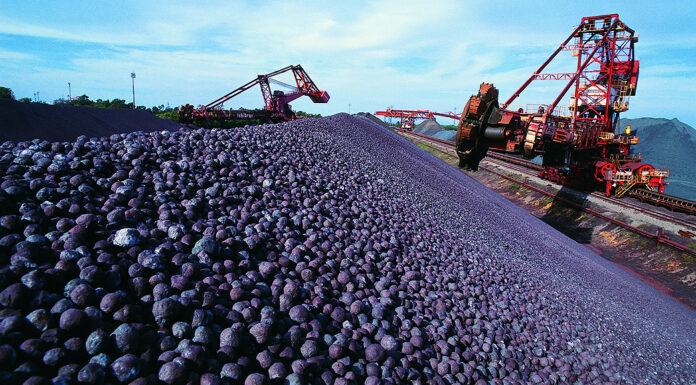

Iron ore supply Chain:

On the supply counter, post two consecutive weeks of upsurge, the seaborne iron ore deliveries declined across the Chinese ports for the week ended 20 July 2019. As per the data, 87 vessels carrying 11.53 million metric tonnes of iron ore arrived across the ports for the week ended 20 July 2019, which was down by 5.99 million metric tonnes from the previous week shipment.

The iron ore deliveries across the Chinese ports from the Australian ports also witnessed a decline; and as per the data, the deliveries from the Australian ports stood at 13.34 million metric tonnes on 20 July 2019, down by 840,000 metric tonnes as compared to the previous shipment on 13 July 2019.

The iron ore prices did not react sharply over the decline in shipment amid an increase in the shipment from Brazil, which witnessed a decrease in shipment previously over the banon the Brazilian iron ore mammoth-Vale. In a public announcement on 22 July 2019, Vale mentioned that the company sold 138 million metric tonnes of iron ore pellet during the first half of the year 2019. Vale further mentioned that the company kept the sales guidance of iron ore materials at 307-332 million metric tonnes for the year 2019.

The resumption in the Vale’s activity kept the upside in iron ore prices in chains.

Apart from Vale’s production prospective, the increased shipment from Brazil curbed the gains expected by investors due to the shipment decline from Australia. As per the data, the shipment from Brazil across the Chinese ports stood at 6.05 million metric tonnes for the week ended 20 July 2019, up by 360,000 metric tonnes as compared to the previous shipment on 13 July 2019.

The Demand Side:

The demand for steelmaking raw material is presently timid in the market amid lower purchase and building steel inventory in China. The steel rebar inventories accumulated for the third consecutive week on 18 July 2019, which coupled with inadequate consumption could impact the iron ore prices in future.

As per the data, the steel rebar inventories across the social and steel mills warehouses inched up by 3 per cent to stand at 8.31 million metric tonnes till 18 July 2019. The social warehouses’ inventory stood at 5.93 million metric tonnes on 18 July 2019.

The building inventory across the warehouses faced a lower demand in the domestic market of China amid seasonal lull and slower downstream activities.

In a nutshell, the iron ore prices are currently capped within a range over the ambiguity on the demand and supply dynamics; and, the steel inventory across the warehouses are building in low consumption environment. The lower consumption and inventory build-up coupled with high iron ore prices could further prompt the steel mills to curb the steel output, which in a cascade could hamper the iron ore prices.

Post understanding the iron ore dynamics, let us now take a look over the Australian iron ore miners such as Rio Tinto (ASX: RIO) and BHP Billiton (ASX: BHP). In the environment of rising iron ore prices, the London-based Liberum downgraded the shares of both Australian iron ore giants previously, as the investment firm believed that the iron ore prices are too high and are being overestimated by the market participants.

However, despite carrying a sell rating, Rio and BHP took advantage of the high iron ore prices and knocked the heaven gates with new 52-week highs.

ASX-Listed Iron Ore Miners:

BHP Billiton (ASX: BHP)

The shares of the Australian mammoth miner surged from the level of A$30.380 (Day’s low on 26 November 2018) to a new 52-week high of A$42.330 (Day’s high on 3 July 2019). The rising iron ore prices supported the company’s share to climb the charts; however, the present ambiguity over the iron ore market are keeping the share prices lower than its recent 52-week high, and the shares are currently trading at A$40.820 (as on 26th July 2019 2:20 PM AEST).

Iron ore Production Update:

BHP produced 238 million tonnes of iron ore (270 Mt on a 100 per cent basis) in the financial year 2019, which ended on 30 June 2019. The iron ore production in FY2019 remained unchanged as compared to the previous financial year (FY2018). However, in June 2019 quarter, the behemoth produced 12 per cent more iron ore against the March 2019 quarter.

The June 2019 quarter production of iron ore stood at 63 million tonnes, which underpinned a 12 per cent quarterly growth. The factor which supported the rise was the increased production of the Western Australia Iron Ore (WAIO), which previously witnessed the impact of the Tropical Cyclone Veronica.

BHP realised an average price of US$77.74 per wmt (on Free-on-Board basis) in June H19 and an average price of US$66.68 per wmt (FOB) in FY2019, up by 18 per cent against the average realised price of US$56.71 per wmt (FOB) in FY2018.

BHP kept the FY2020 production guidance in the range of 242-253 million tonnes or 273-286 million tonnes on a 100 per cent basis over the maintenance program undertaken by the company over Port Hedland, which previously witnessed cyclone damages from Veronica and Wallace.

The overall production of other resources and further guidance is as:

Source: Company’s Report

Rio Tinto (ASX: RIO)

The share prices of the company surged from the level of A$71.750 (Day’s low on 10 December 2018) to a new 52-week high of A$107.990 (Day’s high on 28 May 2019). However, the turnaround in the clear dominancy of the supply shortage kept the prices in the range; and, the shares are currently trading below its 52-week high at A$98.030 (as on 26th July 2019 2:20 PM AEST).

Iron ore Production Update:

Rio’s Pilbara operations production stood at 65.6 million tonnes in the second quarter of the year 2019, which underpinned the growth of 2 per cent as compared to the output of the first quarter of the year 2019. The total production of the Pilbara operations stood at 79.7 million tonnes in the Q2 FY2019, up by 5 per cent from Q1 FY19.

The first-half production of the year 2019 stood at 155.7 million tonnes (129.7 million tonnes to Rio). Despite a production halt in the second quarter, Rio witnessed a 2 per cent increase in production. The company kept the production guidance in for FY2019 in the range of 320-330 million tonnes.

Source: Company’s Report

Nitty Gritty of the Iron Ore Market:

Iron ore market witnessed a supply shortage until recently, which in turn, supported the iron ore prices. However, the high iron ore prices and a hiatus in steel demand coupled with a steep build-up in China could prompt the mills to be reluctant over the procurement, which might exert the pressure on iron ore prices.

Apart from that, the production capacities of significant miners could witness a surge over time, which in turn, could somewhat fill the supply gaps over the long-term.

The investors should also monitor the actions of CISA, which is currently adopting measures to end the supply monopoly in the market and could further lead to a correction in iron ore prices.

Fonte: Kalkine Media