Operational problems and heavy rains in Brazil are affecting iron ore shipments, supporting higher prices for the metal. Iron ore prices jumped on Monday on rising demand amid strong construction and manufacturing activity in China.

Seasonal rains at the Ponta da Madeira port, Vale’s iron ore, and manganese loading terminal in the Northern System have resulted in fewer shipments from Carajás mine.

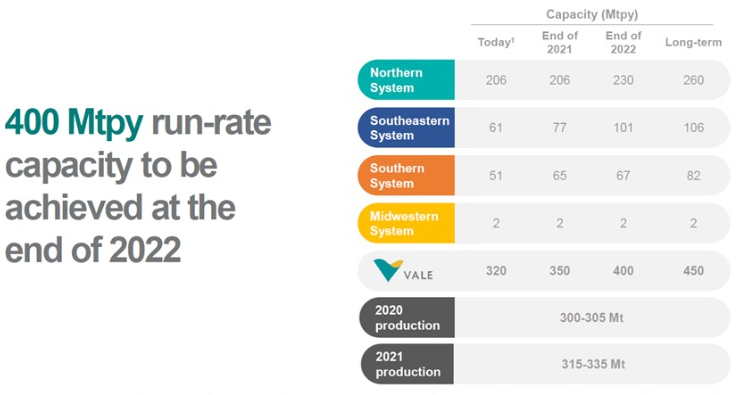

Vale forecasts annual production of between 315 and 335 million tonnes for 2021.

Shipment volume at the Northern System is estimated at 206 million tonnes.

Usually, 45% of the production is shipped in H1, due to extreme weather, which would mean 46.35 million tonnes for the first quarter. Shipment at Ponta da Madeira was at 41.7 million tonnes as of March 31st.

“High rain volumes at major ports will continue to represent a challenge for Brazilian players during 1Q. So far, Brazil is running below guidance,” XP investments said in a note.

According to Fastmarkets MB, benchmark 62% Fe fines imported into Northern China (CFR Qingdao) were changing hands for $165.15 a tonne on Wednesday, down 0.85% from the previous trade.

While price spikes are likely as a result of disruptions due to extreme weather in Brazil and also Western Australia, the longer-term outlook for the iron ore price is squarely in double digits.

Prices are expected to halve by the end of next year and then gradually decline to reach $72 a tonne in real terms by the end of 2026.

Fonte: Mining.com