South Africa’s Harmony Gold Mining Company has entered into a binding agreement to acquire MAC Copper for $1.03 billion, in a transaction that aims to expand the company’s footprint in Australia’s copper sector. The announcement came on May 27, confirming that Harmony, through its Australian subsidiary, will buy 100% of MAC Copper at $12.15 per share—valuing the deal at approximately R18.4 billion.

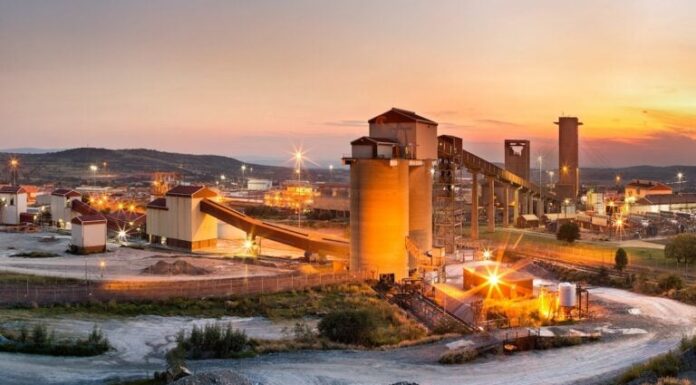

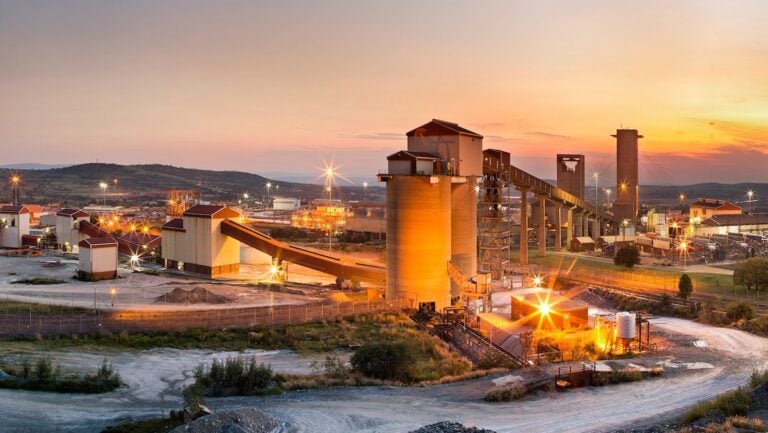

MAC Copper, incorporated in Jersey and listed on the New York Stock Exchange, holds full ownership of the CSA copper mine, an established operation located in the Cobar region of New South Wales, about 700 kilometers northwest of Sydney. The acquisition, if completed, will make MAC a wholly owned subsidiary of Harmony. The CSA mine produced 41,000 tonnes of copper in concentrate in 2023. Known for its high-grade ore, CSA is considered one of Australia’s top-performing underground copper operations. According to Harmony, the mine boasts a C1 cash cost of $1.93 per pound and an all-in sustaining cost of $2.92 per pound, translating to a 36% operating free cash flow margin. The mine currently has a 12-year reserve life, although Harmony noted that ongoing drilling has intersected higher grades, which could extend that life further.

MAC is also progressing with the development of the nearby Merrin mine, north of CSA. That project is expected to begin producing copper and zinc ore before the end of 2025. Harmony CEO Beyers Nel said the acquisition aligns with the company’s focus on building a strong portfolio of high-margin, long-life assets.

The MAC board has backed the deal. In a statement, the board said the offer provides shareholders with “a compelling opportunity to derisk their investment and realise an attractive cash value.” The $12.15 per share price represents a premium on MAC’s recent trading history. The board also pointed to the limited conditionality of the scheme, which, they argued, offers a high level of transaction certainty.

MAC CEO Mick McMullen said the deal benefits all stakeholders at CSA, not just shareholders. He expressed confidence in Harmony’s ability to enhance the mine’s performance and contribute to the surrounding Cobar community. “Harmony is a respected operator with ambitions to grow a significant copper business in Australia,” he said. The acquisition will proceed via a scheme of arrangement under Jersey law. The companies involved—Harmony, its Australian subsidiary, and MAC—have signed an implementation deed. The scheme must now pass several hurdles. It requires approval from a majority of MAC shareholders by number and at least 75% of the voting shares. Regulatory approval will also be needed in both Australia and South Africa.

Harmony itself won’t need shareholder approval, since the deal doesn’t hinge on financing or due diligence conditions. The company plans to fund the acquisition through a $1.25 billion bridge facility and its existing cash reserves. Citibank (London and Jersey), JP Morgan Securities, JP Morgan Chase Bank, and Macquarie Bank are underwriting the facility.

As of March 31, Harmony reported a record net cash position of $592 million (R10 billion) and had $1.1 billion (R20 billion) in available cash and undrawn credit lines. For its part, MAC reported $75 million in cash and cash equivalents and $150 million in net debt at the end of the same quarter. Harmony has indicated it will refinance the bridge facility later under more competitive terms. The company has not specified which refinancing options it is considering, but Nel said several paths are available.

If the deal moves forward, Harmony will take over the existing offtake agreements MAC signed with Osisko and Glencore. Osisko has agreements that cover all payable silver output from CSA and up to 4.8% of total refined copper. Glencore’s Australian arm holds a 1.5% net smelter return royalty on CSA’s copper production. There is also a sale and purchase agreement between MAC and Glencore involving up to $150 million in contingent payments, including a $75 million one-time payment if copper prices average above $4.25 per pound for 18 consecutive months.

This acquisition is the latest in a series of international deals Harmony has executed over the past decade. The company acquired Papua New Guinea’s Hidden Valley gold and silver operation in 2016, followed by South Africa’s Moab Khotsong gold and uranium project in 2018. In 2020, it took over the Mponeng gold mine and the Mine Waste Solutions operations. Harmony entered the Australian copper space more recently with its acquisition of the Eva copper project in Queensland in 2022.

Together with Eva and the CSA mine, Harmony expects to become a 100,000-tonne-per-year copper producer in Australia within five years.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

The post Harmony Makes $1.03 Billion Play for Australian Copper Asset in Major Expansion Move appeared first on MiningFeeds.