Gold extended its recovery from the recent selloff on Friday as a retreat in the US dollar enticed investors to snap up the safe haven metal.

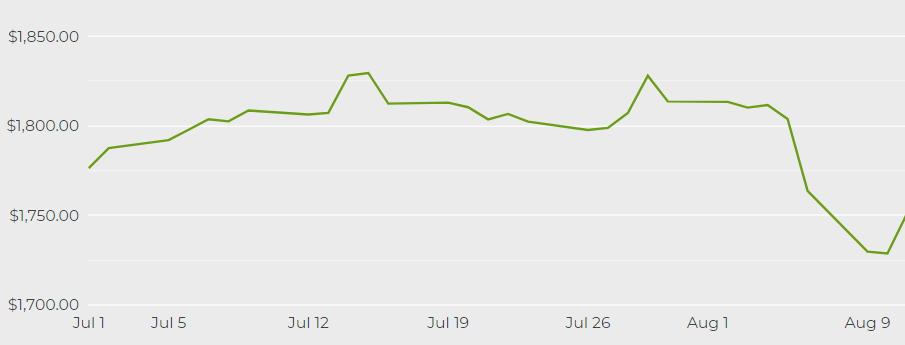

Spot gold rose 1.3% to $1,776.83 per ounce by 12:10 p.m. EDT, its highest in more than a week, representing a quick turnaround from the four-month lows touched on Monday. US gold futures jumped 1.5% to $1,779.20 per ounce in New York.

Meanwhile, the dollar index fell 0.4% and US benchmark 10-year treasury yields also weakened, bolstering the appeal of gold, a non-yielding asset.

Providing further support to bullion was an increased physical demand, particularly from top consumers India and China, where premiums rebounded to multi-month highs.

Commenting on gold’s recent movement, TD Securities commodity strategist Daniel Ghali told Reuters that the pullback from Monday’s lows was largely driven by technicals, with increased central bank purchases providing additional support.

“But, this pullback could just be a temporary move higher,” Ghali added, noting that speculative interest was waning amid rising expectations that the US Federal Reserve could cut back on economic support sooner.

The tapering bets received a major boost last week following a strong US jobs report for the month of July, sending gold on a downward spiral for three straight sessions.

“The picture remains nuanced; as positive signs in the labour market and spikes in producer prices support the view that the Fed will bring forward the timing of tapering, but the latest consumer price increases supported the view that inflation spikes are transitory,” said Ricardo Evangelista, a senior analyst at ActivTrades.

“Amidst the mixed signals, investors anticipate what will emerge from the Fed’s Jackson Hole meeting later this month,” he added.

While gold is seen as a hedge against inflation, higher interest rates dull the bullion’s appeal by raising its opportunity cost.