Gold is headed for a fourth consecutive day of gains, reaching a three-week high Friday as fears grow over a second wave of covid-19 outbreak as global economies begin to reopen.

China and South Korea are on alert once again as they face a rising number of new infections. In the US, the state of Texas recorded its largest daily increase in cases and deaths Thursday since the start of outbreak, the Texas Tribune reported.

The potential of another surge in covid-19 cases, combined with weak economic data coming from major markets like the US, raises more uncertainties for a near-term recovery, making safe-haven assets like gold more attractive to investors.

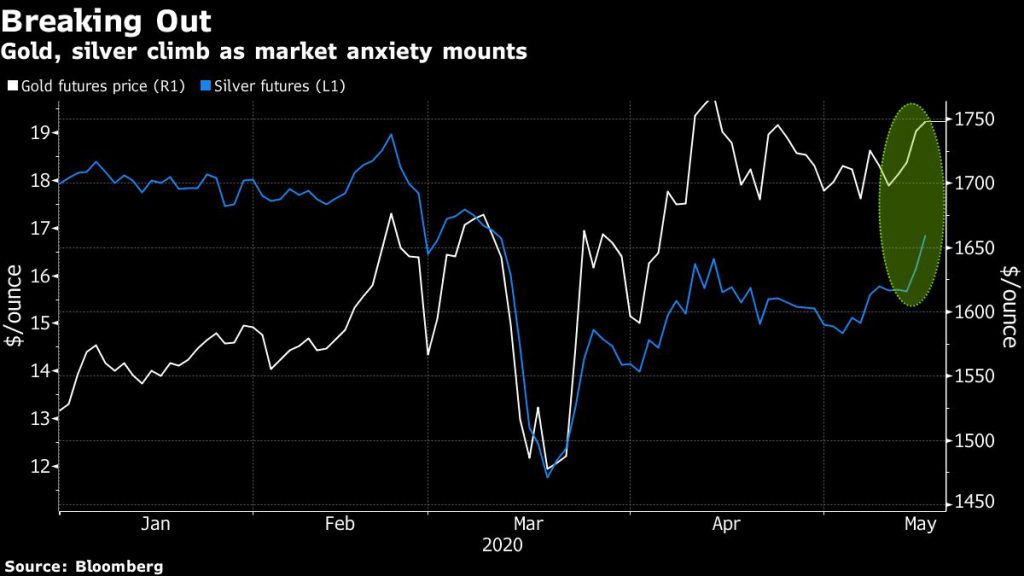

Bullion rose 0.9% to $1,747.94 an ounce as of 1:30 p.m. EST, approaching its peak in April when the price was at a seven-year high. Gold futures for June delivery traded 1.1% higher at $1,759.50 an ounce on the Comex in New York.

The silver market also rallied to its highest in two months, up 4.8% to $16.66 an ounce.

The anticipation of further fiscal and monetary measures will likely fuel further demand for precious metals, as they have in the past.

“Everybody must have realized it, but it’s just more evidence that the reality is this is a pretty bleak economic picture right now,” Phil Streible, chief market strategist for Blue Line Futures LLC, said in a Bloomberg interview.

“People are continuing to pile into gold because that weak economic picture is going to continue to drive interest rates lower,” he added.

“There are fears over everything from political leadership through the health outlook overall and associated economic-financial and political risk,” Rhona O’Connell, head of market analysis for EMEA and Asia at INTL FCStone, told Bloomberg.

Prices are having a long-awaited breakout moment as market anxiety mounts, she said.

Fonte: Mining.com