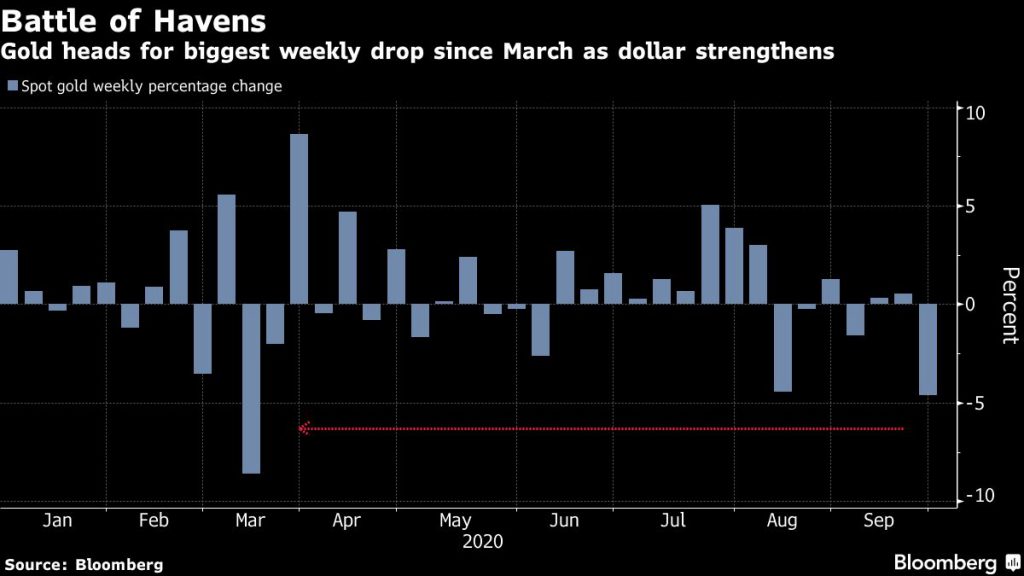

Gold declined further on Friday and is now set for its biggest weekly loss since the coronavirus panicked global markets in March.

Meanwhile, the US dollar rallied again as risk aversion among investors continues to rise following a warning from the US Federal Reserve that economic recovery will stall without further stimulus.

The outlook for the global economic recovery is being hit by fears that rising coronavirus cases — particularly in Europe — may lead to more national lockdowns.

Traditionally, this would have strengthened the investment appeal of safe haven assets such as gold, but falling inflation expectations do not bode well for the precious metal, which is often seen as a hedge against inflation.

“We are seeing quite a significant shift as far as risk appetite is concerned, while that typically favours gold, for the vast majority of this year that has not been the case,” OANDA analyst Craig Erlam told Reuters.

The risk-off move has favored a major dollar rebound and that’s been a massive drag for gold, he said, adding “I don’t think its going to be much longer before we are talking about $1,800.”

“Abating concerns about inflation due to rising corona numbers could have something to do with this,” Commerzbank AG’s Carsten Fritsch wrote in a note.

If “people have to restrict their social contacts again, the price pressure will ease, meaning that the extraordinarily high monetary dynamism will not reach consumer prices.”

Other precious metals like platinum and palladium are also headed for their worst week since the pandemic began to impact economies. Both metals are down 0.7% and 1.2% respectively.

Chance for rebound

Bullion’s decline could be temporary though, according to some analysts. Uncertainty over the upcoming US election may prove a boost for gold, as any added conflict in the run-up to the vote should help lift the precious metal, according to RBC Capital Markets strategist Christopher Louney.

“The US election cycle and any potential transition, as well as heightened geopolitical tensions, remain amid economic uncertainty,” Louney wrote in a note. “The recent moves open up room for gold to move higher more materially” in the next two quarters.

Earlier this week, Citigroup analysts said risks surrounding the US presidential election could still propel gold to a new record before the end of the year.

Fonte: Mining.com