As Freeport McMoRan hammers out next year’s benchmark deal for the copper industry, the coronavirus has complicated negotiations but also given the miner an edge.

Gone is an ice-breaking reception for key customers that Freeport’s Javier Targhetta hosted for more than two decades during London Metal Exchange Week. For the past few years, that’s seen CEO Richard Adkerson serenade hundreds of guests as they dined on champagne and paella at a Park Lane hotel.

While virtual talks are proceeding more slowly than traditional face-to-face meetings, senior VP of marketing and sales Targhetta is targeting similar contractual terms to this year. That’s partly because the pandemic is stoking market uncertainty and keeping mine supply tight, a central pillar in copper’s rebound to a two-year high above $7,000 a tonne last week.

“We definitely see a continuing deficit of concentrate in the market,” said Targhetta, referring to the mined ores extracted by Freeport and other producers. “I’d look at a small number plus or minus,” compared with the current benchmark, he said.

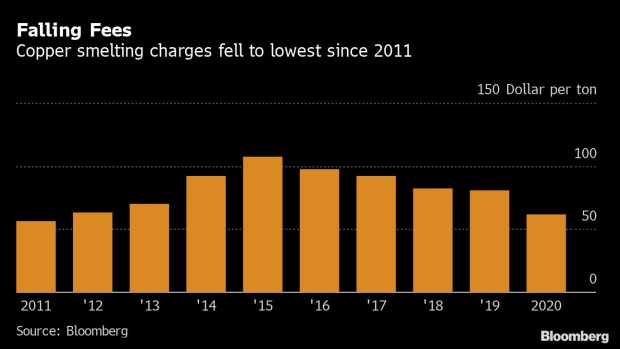

Even before the pandemic, tight supply for concentrates had enabled Freeport to strike deals for 2020 that offered the lowest processing fees in nine years.

This year, the supply of copper from mines in South America was hit hard by the pandemic, while imports into China reached record levels as the country’s economy rebounded. While negotiations for 2021 are at an early stage, a projected deficit for concentrates means Freeport doesn’t expect to see any major changes in the treatment and refining charges it pays smelters to turn mined ores into metal, Targhetta said.

HIGHER PRICES SHOULD PROVIDE AN INCENTIVE FOR MINERS TO MAXIMIZE OUTPUT NEXT YEAR, POTENTIALLY ALLEVIATING SOME OF THE STRAIN ON SUPPLY

Freeport VP of Marketing Javier Targhetta

As the world’s largest listed copper miner, the deals Freeport signs with its Asian customers typically set the benchmark for the rest of the industry, and negotiations are closely watched by investors as a barometer for supply and demand for the coming year.

Even without the bonhomie of LME Week’s gala dinners and after-parties, one tradition appears to have remained intact: many in the industry finished the week feeling more bullish on copper’s prospects than they were at the start.

“After a week full of virtual meetings, our bullish view on copper first established in April and reaffirmed in August hasn’t changed,” JPMorgan Chase & Co. analysts said in an emailed note, forecasting that prices could hit $7 500 in the second quarter of 2021. “While there were some disagreements around the price targets during our calls, we concluded that this constructive view on copper seems to be consensus by now.”

Higher prices should provide an incentive for miners to maximize output next year, potentially alleviating some of the strain on supply, Freeport’s Targhetta said.

While he expects that changes in next year’s processing fees will be small, smelters are pressing for a more significant increase to shore up their margins. The head of Aurubis, Europe’s largest copper producer, said treatment and refining charges are unjustifiably low.

“It’s difficult to say what will happen for next year, but for me one thing is clear: this level is not the right level,” Roland Harings said in an interview.

Harings said he’s looking forward to the day when the industry will be able to iron out such commercial differences face-to-face again. He may cut back on travel, but big industry events like LME Week are still going to play a vital role, he said.

On that, Freeport’s Targhetta agrees.

“It’s always difficult, but now it’s much more difficult,” he said, referring to ongoing negotiations. “I’m just looking forward to everyone getting back to normal, and for the pandemic to be over.”

(By Mark Burton, with assistance from Jack Farchy)

Fonte: Mining.com