While the covid-19 pandemic has had a negative effect on the platinum market — including price, demand and supply — results for Q1 2020 show the net effect is less than feared, and the outlook for 2020 is better than expected, according the latest quarterly report by the World Platinum Investment Council (WPIC).

Platinum price fell together with that of most equities and metals during the crisis, suffering falls of between 10% and 35% in the month of March.

Total demand in Q1 2020 declined by 5% (94 koz) to 1,649 koz from the previous quarter, while total supply decreased by 19% (410 koz) to 1,773 koz from Q4 2019, resulting in a surplus of 124 koz for Q1 2020.

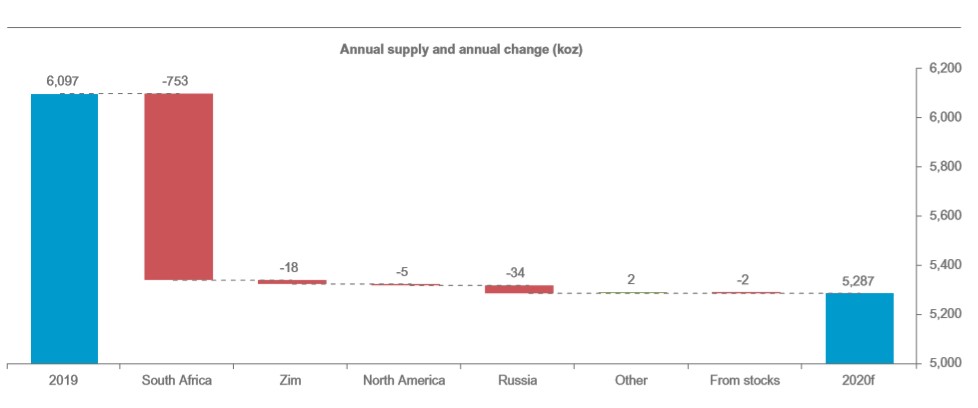

Demand in China reduced early in the quarter, but a smelting process failure in South Africa unrelated to the pandemic as well as mine closures to reduce the spread of the virus significantly reduced the quarterly platinum supply.

The WPIC now forecasts that 2020 will have a surplus of 247 koz, which is 128 koz higher than its previous forecast despite the impacts of covid-19.

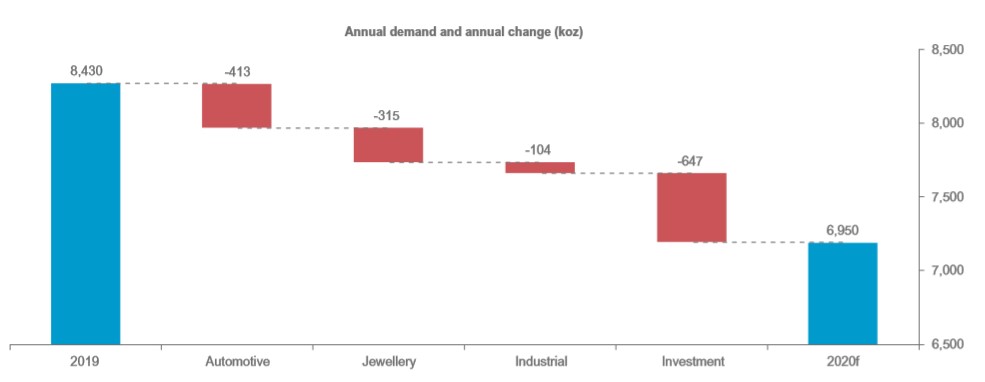

Demand is expected to be 18% lower than in 2019, mainly on weak automotive and jewellery sales and lower investment demand. Supply is forecast to be down 13% year-on-year on the material impact of the smelting outage and pandemic-related mine stoppages.

Strong investment demand

As platinum prices declined to decade-low levels for parts of the three-month period, investors acted on the price fall as demand for bars and coins constituted 19% of the total demand in Q1 2020, up from 2% in the previous quarter.

Investment in bars and coins surged to 312 koz in Q1 2020 – up over 300% on the quarterly average of 70 koz in 2019, driven largely driven by bargain-hunting following the price fall in March. For the year, bar and coin investment demand is expected to surge by 115% to 605 koz.

Emissions legislation to spur demand

The automotive sector — the largest consumer of platinum metal — saw demand decline 17% (132 koz) to 634 koz year-on-year as covid-19 induced plant closures led to a rapid drop in manufacturing output and an unprecedented fall in sales.

While total automotive platinum demand is forecast to fall by 14% (413 koz) in 2020, demand in China is expected to increase by 14% despite the effects of covid-19.

The phasing in of China VI standards for heavy-duty vehicles drives an increase in loadings that outweighs the expected decline in units produced. Similarly, the implementation in India of the Bharat VI legislation in April 2020 is also likely to increase demand for platinum despite the lockdown restrictions that are currently in place.

“Reducing CO2 emissions remains a global imperative and automotive manufacturers in Europe have been preparing for this for several years. In 2020, we are likely to see increased platinum demand as automaker CO2 strategies include the wide range of diesel and diesel hybrid vehicles already on sale and which have higher platinum loadings,” said Paul Wilson, CEO of World Platinum Investment Council.

“Palladium demand growth, unrelated to covid-19, and its high price maintains the need for platinum to replace palladium in autocatalysts in the world’s two largest passenger car markets, China and North America,” he added.

Fonte: Mining.com