Covid-19 has impacted the mining industry across the globe as lockdowns and travel restrictions forced companies to halt or scale down operations, suspend work on projects, and re-opening plans are scuppered by fresh outbreaks.

S&P Global Market Intelligence in a new report measures the impact of these mine closures and project delays, showing Latin America is the hardest hit in terms of the value of at-risk production.

GLOBAL MINING HAS ESCAPED THE WORST OF COVID-19 IN TERMS OF PRODUCTION DISRUPTIONS BECAUSE MAJOR PRODUCING NATIONS ACROSS LATIN AMERICA AND COUNTRIES LIKE CANADA AND SOUTH AFRICA DECLARED MINING ESSENTIAL INDUSTRIES

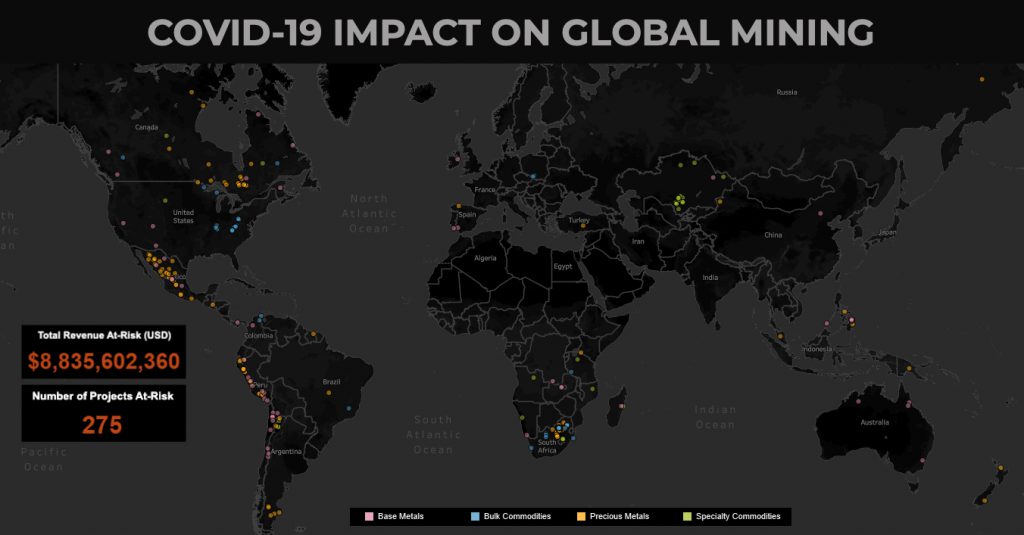

In total, $8.84 billion in mining revenue is classified as at-risk and S&P Global identified, as of June 25, disruptions to 275 mine sites in 36 countries. The research company notes that all but 36 mines have reopened to some degree, with only four having to re-close so far due to new outbreaks at mine sites.

Global mining has escaped the worst of covid-19 in terms of production disruptions because major producing nations across Latin America and countries like Canada and South Africa declared mining essential industries.

S&P Global says there have been a number of reported cases that did not result in mine closures or an impact on production:

In April, there were reports of an outbreak in Norilsk’s northern Russia that did not result in mine closures.

Chile’s National Copper Corp., or Codelco, has reported cases since mining was declared essential with no further closures to mine sites, although development activities have been halted for the time being.

Similarly, Vale SA has reported cases in Brazil that have not caused further disruptions.

Peru, Chile and Mexico hardest hit

Not surprisingly, copper and base metal revenues make up the bulk of the global total with $4.3 billion and 55 projects at risk.

On a revenue basis Peru is responsible for nearly a quarter of the total as large-scale copper operations including Antamina, Cerro Verde and Las Bambas are affected by temporary nationwide quarantines.

Ten at-risk copper operations in Chile including the giant Los Pelambres copper mine (production revenues of nearly $700m) and Codelco’s top mines add up to $1.1 billion is possible revenue losses from covid-19 in the world’s top copper mining country.

Mexico’s 15 gold and 13 silver operations, with just over $1 billion in at-risk revenues means that these three countries combined constitute almost half the global total in terms of revenues.

South African slump

On a per mine basis, South Africa is most impacted with 55 projects at risk, including the giant Sishen iron ore mine, and 21 gold and 16 platinum mines adding up to $1 billion in potential covid-19 related revenue losses.

In contrast, the Democratic Republic of Congo’s mining revenues have not been impacted at all. S&P Global identifies Ivanhoe Mines’ Kamoa-Kakula as possibly at risk, but so far construction of the massive copper mine remains ahead of schedule.

Latin America and South Africa’s dire circumstances also compare to the US where 42 projects – mostly coal – comes to a much smaller $402 million in affected income. Canada has 30 projects (19 gold) at risk with the Voisey’s Bay nickel mine the largest operation affected.

122 precious metals projects at risk

Precious metals mining is the most severely impacted sector in terms of operations, with 122 at risk globally including 23 expansion, construction and pre-production projects.

Operating gold mines under threat of disruption total 111 mines closely followed by silver, with 101 operations and 16 platinum projects. Precious metals constitute $3.4 billion at risk.

Covid-19 has had a relatively significant impact on uranium mining, with 24 projects with revenues totalling $495 million at risk, while lithium mining has escaped relatively unscathed apart from a handful of projects in Argentina.

Click here for S&P Global Covid-19 Mining Impacts Tool

Por Frik Els

Fonte: Mining.com