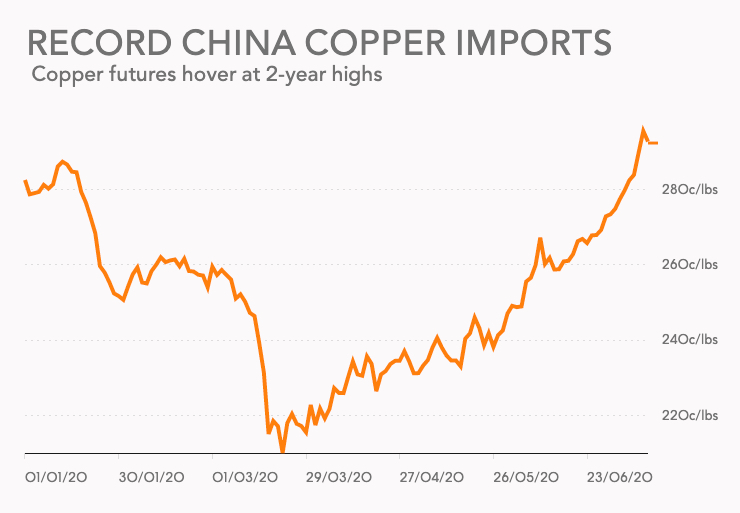

Copper futures prices remained within shouting distance of the $3 a pound level on Tuesday on the back of a surge in Chinese imports of the metal and worries about supply from South America.

Copper for delivery in September trading in New York changed hands for $2.9460 a pound ($6,495 a tonne) in early afternoon trade, easing back from yesterday’s close at a two year high.

Another indication of demand outstripping supply is treatment and refining charges falling to an eight-year low.

In March, the bellwether metal briefly traded below $2.00, levels last seen during the global financial crisis of 2008-2009, but has now recovered by nearly 50%.

Customs data released overnight showed China’s unwrought copper imports (anodes and cathodes) in June rose a stunning 50% from the previous month to 656,483 tonnes – a full 15% above the previous monthly record.

June cargoes were double that of the same month last year as the infrastructure and manufacturing sectors in China, responsible for more than half the world’s copper consumption, rapidly recover following the covid-19 slump.

Over the first half of 2020, imports totalled 2.84m tonnes – up 25% year-on-year and on track to easily beat 2018’s annual record of 5.3m tonnes.

June imports of copper concentrate fell unexpectedly, down 6% to 1.69m tonnes from May, but still up 8.4% from June last year.

BMO Capital Markets said in a note that the fall in concentrate imports was not due to a lack of demand but a shortage of mine supply – the world’s no. 2 producer Peru suffered a 40% fall in output in May.

Another indication of demand outstripping supply is the decline in treatment and refining charges. TC/RCs paid by miners to smelters have fallen to an eight-year low, a sign of competition between refiners for available concentrate.

For the first six months of 2020 imports total 10.84 million tonnes, on pace to surpass last year’s record-breaking tally of 22 million tonnes.

Por Frik Els

Fonte: Mining.com