The Canadian mining sector remains cautiously optimistic as it confronts the possibility of 25% tariffs on all Canadian goods entering the United States. U.S. President Donald Trump made this announcement in a series of statements that have stirred unease among Canadian industries, which are closely tied to the U.S. market.

The mining industry, responsible for exporting over half of Canada’s mineral output to the United States valued at more than C$80 billion in 2022 appears quietly confident about weathering the storm. Industry leaders and analysts point to the deep interdependence of the two nations’ economies, particularly in critical minerals, as a potential buffer against sweeping tariffs.

The Stakes for Canadian Mining

Canadian mineral exports support many U.S. industries, particularly in the supply of critical minerals like nickel, aluminum, and germanium. Pierre Gratton, president and CEO of the Mining Association of Canada, highlighted the strategic importance of these materials in a recent interview, especially amid U.S. efforts to reduce reliance on Chinese supply chains.

When China imposed a ban on the export of germanium to the United States, Canada stepped in, Gratton explained. This underscores the value of our trade relationship and the mutual dependence between our countries.

Trump’s recent comments suggest a broader reassessment of Canada’s role in the U.S. economy, citing American self-sufficiency in key sectors like energy, automotive manufacturing, and lumber. Despite this rhetoric, experts question whether the U.S. would truly jeopardize its access to vital Canadian resources.

Industry Voices Express Skepticism

Prominent mining figures have cast doubt on the likelihood of Trump implementing the tariffs. Pierre Lassonde, a founder of Franco-Nevada and former president of Newmont, suggested such measures would be counterproductive.

All mine output is raw material for the U.S. industrial complex, Lassonde noted. [Tariffs] would raise costs for consumers and disrupt the flow of critical metals that the U.S. needs. It doesn’t make economic sense.

Stephen Roman, founder of Gold Eagle Mines and now head of Global Atomic, echoed this sentiment, calling Trump’s statements a negotiating tactic. At the end of the day, raising costs for mineral products, whether oil, gas, or metals, wouldn’t benefit either country. This is about getting attention and leverage.

A Longstanding Partnership Under Pressure

The U.S. and Canada have a long history of collaboration in critical mineral development, formalized in Trump’s first term through the Joint Action Plan on Critical Minerals Collaboration. This initiative aimed to strengthen North American supply chains for minerals essential to industries like defense, technology, and clean energy.

Clifford Sosnow, an international trade lawyer, recently noted that the U.S. has already funneled millions of dollars into Canadian critical mineral projects to reduce dependence on China. This context complicates Trump’s tariff threat, as such actions could undermine existing efforts to build a North American mineral alliance.

He’s signaling the need for alternative supply sources, which should create opportunities for Canada, Sosnow said. But his rhetoric introduces uncertainty that could stall progress.

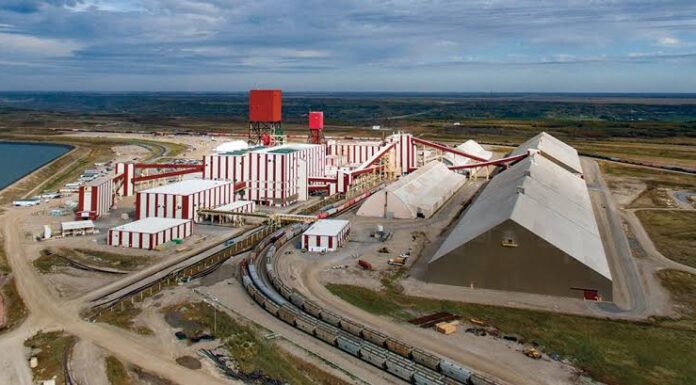

The threat of tariffs has ignited political and economic debate on both sides of the border. Canadian leaders have issued mixed responses, ranging from calls for retaliation to concerns about the broader impact of a trade war. Alberta Premier Danielle Smith and Saskatchewan Premier Scott Moe have expressed fears that tariffs could severely impact revenue from their provinces’ oil, gas, uranium, and potash sectors.

Ontario Premier Doug Ford has adopted a more combative stance, advocating for strong retaliatory measures. We need to match these tariffs dollar for dollar and target areas that will hurt the U.S. most, Ford told reporters.

Prime Minister Justin Trudeau, who recently announced plans to step down, agreed on the need for a firm response, warning that tariffs would drive up costs for American consumers. This is not something Canada wants, Trudeau said. But if necessary, we will respond robustly.

Federal Conservative leader Pierre Poilievre struck a similar tone, though his comments avoided specifics. Political analysts suggest his hesitation may reflect a desire to balance support for Alberta’s energy sector with broader national interests.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

The post Canadian Mining Industry Confident Despite Trump’s Tariff Threat, Highlighting Strong US Trade Ties appeared first on MiningFeeds.