The prospect of 25% tariffs on copper imports from Canada and Mexico under a potential second Trump administration could have far-reaching effects on the global copper trade. While the timeline and likelihood of any changes are still uncertain, some experts are warning that these tariffs would ripple through supply chains, disrupt existing trade relationships, and impact industries reliant on copper, such as automotive manufacturing.

Current Copper Trade Dynamics

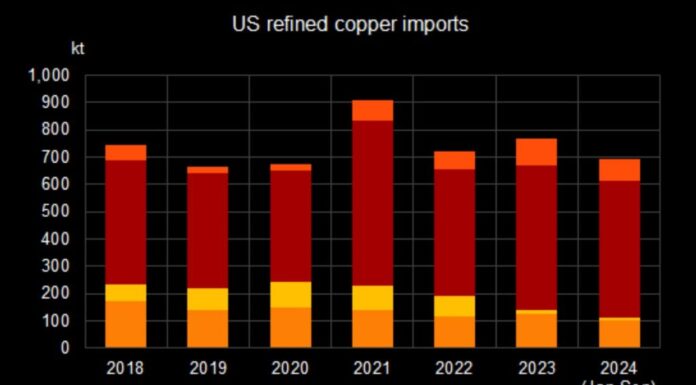

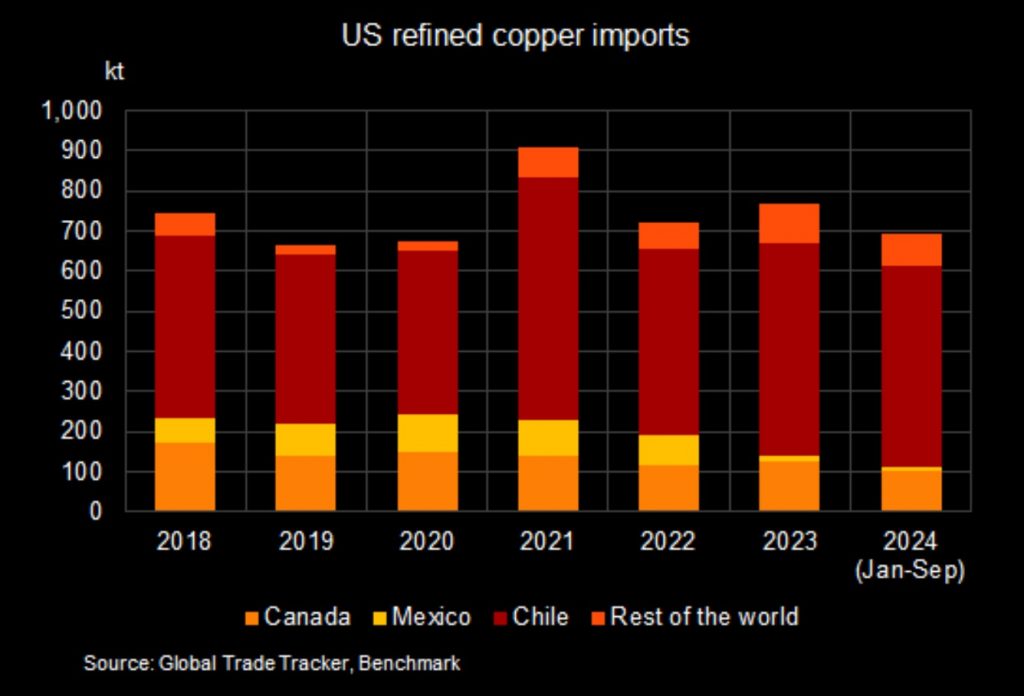

In 2023, US imports of refined copper totaled 767,000 tonnes, with 128,000 tonnes coming from Canada and 14,000 tonnes from Mexico. Together, these two countries accounted for about 16% of the US’s total copper imports last year. Chile remains the largest supplier of refined copper to the US, followed by Canada and Peru. The US also exported 33,000 tonnes of refined copper last year, net of re-exports.

Canada’s role in the US copper market extends beyond refined copper. The country exported 207,000 tonnes of copper and copper alloy semi-finished products to the US in 2023, representing 42% of the total US imports in this category. A significant portion of these imports consisted of copper wire rod, with Canada supplying over 80% of the US’s wire rod requirements over the past decade.

Benchmark recently predicted that Canadian and Mexican copper imports could lose their cost competitiveness under the proposed tariffs. US buyers would likely seek alternative suppliers, such as Chile for refined copper and countries like Korea, Japan, or India for semi-finished copper products. This shift could redraw global copper trade routes, creating new challenges and opportunities for producers and exporters.

The tariffs could also incentivize investment in domestic copper production, though Benchmark notes that no formal incentives have been proposed to support US manufacturers. While the Inflation Reduction Act demonstrated that domestic industries can grow with the right incentives, the current strategy appears focused on raising costs for imported materials rather than bolstering local production capabilities.

Copper Market Reacts to Trade Uncertainty

Copper prices saw a brief uptick this past month, an increase mostly attributed to a weaker dollar. But prices still site below pre-election levels, down 6% from earlier this year. The uncertainty surrounding Trump’s potential trade policies has also caused Chinese importers to shy away from US copper scrap, adding another layer of complexity to the market.

China imported approximately 300,000 tonnes of copper scrap from the US this year, meeting over 17% of its annual demand. The US currently stands as China’s top supplier of copper scrap, but this relationship could change. The situation has some similarities to the 2018 trade war, when China imposed 25% tariffs on US-origin copper scrap in response to Trump’s trade policies.

The above references an opinion and is for information purposes only. It is not intended to be investment advice. Seek a licensed professional for investment advice. The author is not an insider or shareholder of any of the companies mentioned above.

The post Potential Trump Tariffs Could Reshape Copper Market Dynamics in 2025 appeared first on MiningFeeds.